Denials rank among healthcare providers’ undeniable financial threats: all costs have been incurred, but payment is still outstanding. Claims are denied for many reasons, from insufficient information for adjudication to non-coverage of the service, and more. A typical practice should see no more than 3% denials: if yours are greater, we can help.

Why are claims denied and what are the consequences?

- Poor front-end process: Front office staff must understand what’s needed to avoid denials. Improper patient registration, unverified insurance, ineligibility or inadequate benefits coverage are all common reasons for denial that can be easily avoided.

- Inadequate internal scrubbing of claims to detect errors in codes or modifiers.

- Inaccurate posting adjustments: Automatic acceptance of write-offs without further analysis provides no understanding of why claims are denied, preventing remedial action. Research at the time of posting can identify claims suitable for followup.

- Denial rate disparities: Denial rates often vary among insurers and medical specialties, and between geographical regions. To identify problems, anyone filing claims must know the usual industry average denial rate in each case.

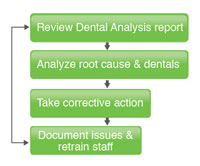

- Incorrect denials analysis: Analysis of denials data suggests that multiple denials frequently occur for similar reasons, either for a particular patient or for a particular provider. Patterns must be detected in denials and the insights used to improve processes that minimize the risk of similar future denials.

- Error detection by automated processes: Many payers use automated processes to review incoming claims. The software that underpins such reviews is designed to return a claim to the provider even if it detects a minor error.

- Appeals are costly and can worsen your cash flow: It typically costs a provider $14 for each denial appeal, whether successful or not. (The alternative? Write off the whole loss.)

How NDS helps providers manage denials?

NDS delivers an integrated suite of services designed to minimize denials and produce successful outcomes. Among others, we:

In broad terms, NDS will:

- Create trended denial analysis and denials resolution reports segmented by:

- Practice

- Financial class

(Medicare, Medicaid, private insurance etc.)

- Physician

- Payer

- Others as required

|

|

|

- Create detailed reports of denied claims based on payers’ timely filing limits, and reports showing denials as a percentage of total charges.

- Calculate the resolution percentage to determine how many denials were overturned.

- Set appropriate time-frames for followup at each stage of an outstanding claim, as well as daily and weekly goals of denials to be targeted.

- Generate revenue reports that track payments, adjustments and bad debt write-offs

- Provide assistance with improving front-end billing processes and clearinghouse edits.

- If required, speak with payers to discuss denials issues.

|

Quantifiable gains

NDS customers typically see:

- Reduction in denials from the industry average of 15% to less than 5%

- A successful denial appeals rate of 60% or better

- All denials addressed within five business days of identification

- 5-10% reduction in 120-day accounts receivable

- Comprehensive revenue reporting

|